Wine Exports Top $1 Billion

Tally for 2008 up 6% in value to reach historic record

U.S. WINE EXPORTS* Year to Date: January-December, 2008 and 2007 Preliminary numbers. History revised. *All totals include re-exported wines. Source: U.S. Dept of Commerce, STAT-USA. Copyright: California Wine Export Program.

San Francisco, Calif. -- For the first time in history, U.S. wine exports exceeded $1 billion in 2008. The total was $1,008,259,000 in winery export revenues, up 6% from the previous year, according to the San Francisco-based Wine Institute.

Volume shipments in 2008 increased 8% compared to the previous year, to nearly 130 million gallons or 55 million cases. These numbers indicate that the value of the wine dropped slightly, reflecting in part increasing bulk shipments that are bottled overseas to save on transportation and packaging costs. The finished wines are then shipped to their final destinations, some in neighboring countries.

By volume, 90% of the exports are from California.

"Wine exports have increased steadily during the past 15 years, increasing more than five-fold from $196 million in 1994. Our wineries have been able to adjust and remain competitive despite changes in U.S. dollar exchange rates and during strong and weak economic conditions," said Robert P. (Bobby) Koch, president and CEO of Wine Institute.

"Wine is California's second-leading export product by value, and there is great opportunity to build upon this progress, as the U.S. is the world's fourth-leading wine producer yet holds a 6% share of the world export market," said Linsey Gallagher, Wine Institute international marketing director.

To continue the momentum, Wine Institute, represented by its director of international trade policy Joseph Rollo, is collaborating with the U.S. government and international organizations to help assure implementation of the 2006 EU-U.S. Wine Trade agreement and to reduce high tariffs, production subsidies and other restrictive trade barriers throughout the world.

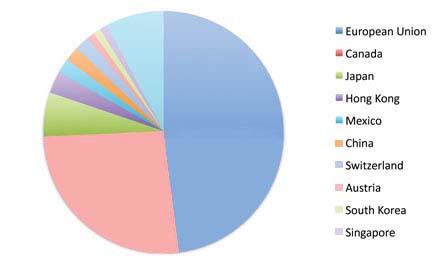

Nearly half of U.S. wine exports are shipped to the European Union, accounting for $486 million. Volume shipments to the European Union increased 9% in 2008 compared to 2007, and sales by value grew at a lower rate of 2% due to the bulk wine exports.

The next leading markets were: Canada, $260 million; Japan, $61 million; Hong Kong, $26 million; and Mexico, $23 million.

"In tough trading conditions, California continued to build market share in the United Kingdom," said John McLaren, Wine Institute's trade director for the UK. "The highlight was overtaking France for the No. 2 slot behind Australia. California has the right combination of developed brands, flexible and responsive producers, and a huge diversity of quality varietals to weather the current business climate. I believe we are the best equipped to meet future challenges and build both on our consumer perceptions and our market position."

"While we are also starting to see the effects of the financial crisis on the European wine markets, California has performed well in Europe in 2008," said Paul Molleman, trade director for Europe. Exports to the key market of Germany are on the rebound, as there is renewed importer interest in adding California to their portfolios, and sales are up in most countries. The best example is Poland, where California's positive image and availability of excellent value wines have resulted in a 14% market share, well ahead of France."

"In Canada, retail wine sales for California wines exceeded 3.2 million cases for the first time ever, helped by favorable exchange rates, exciting new product introductions and several very successful liquor board promotions," said Rick Slomka, trade director for Canada. "The most impactful promotion was the partnership with the Liquor Control Board of Ontario to create a fully-integrated marketing campaign called 'California Style,' probably the largest retail promotion of California wines ever outside the U.S. market. These promotions provided the category with ongoing momentum, which is carrying over into 2009."

Japan trade director Ken-ichi Hori said California wineries were also shipping sizeable branded volume as bulk wine for packaging and bottling in Japan to economize on transportation costs and reduce the import duty on wine. "Bulk wine shipments have skyrocketed 1,035%, and 2008 U.S. bottled table wines have increased in value 6.5% over 2007, despite a significant volume decrease. This means California is selling more expensive wines to Japan."

Growth in other markets include: China, up 34% to $22 million; Austria up 31% to $14 million; and Singapore, up 26% to $11 million.

"Regionally, greater China showed tremendous growth in 2008. Hong Kong was buoyed by its repeal of the local import tax on wine, and has quickly become the wine hub for Asia. California wine exports to Hong Kong clearly outpaced that of our major competition," said Eric Pope, regional director, emerging markets.

"China remains the most sought-after export market worldwide, due to its sheer population size. Growth continued, albeit at a slower rate than in 2007--perhaps a first sign that the global financial crisis is impacting the Chinese market for imported wine."

Since 1985, Wine Institute has served as the administrator of the Market Access Program, an export promotion program managed by the USDA's Foreign Agricultural Service. Currently, more than 150 California wineries participate in the Wine Institute's International Program.