Breaking baijiu business

UK-based Diageo, the world's largest spirits, beer and wine company, has met a setback in its progress in China, the world's biggest spirits consumer market, after it failed to reach an agreement following week-long talks held recently with its Chinese partner, Sichuan Chengdu Quanxing Group.

Diageo, which owns 49 percent stake in Quanxing, held talks with Chengdu Yingsheng Investment Holding, which owns the other 51 percent stake between September 9 and Tuesday concerning Diageo's desire to increase its share in Quanxing by 2 percent.

During the negotiation period Quanxing's listed subsidiary Sichuan Swellfun (SCSF), a Chinese premium baijiu (Chinese white spirits) producer, suspended trading to avoid influencing its market activity on the Shanghai Stock Exchange. SCSF has since resumed trading Wednesday and no further talks are planned for at least the next three months, SCSF said in a company announcement.

"We have held discussions to deepen our cooperation in the holding company but these were at a preliminary stage as this resumption of the trading recognizes," Diageo Greater China told the Global Times in an e-mail statement.

SCSF declined to comment on the talks. Its stock price closed at 16.84 yuan ($2.46) Thursday, lower than 17.01 yuan ($2.49) before it suspended trading.

While neither Diageo nor Quanxing confirmed specifically that the talks were about Diageo's desire to increase its stake, the resumption of SCSF's trading is a sign that Diageo failed to increase its stake in Quanxing, Chen Chen, an analyst at Shenzhen Zhongzhe Investment Consultant (SZIC), told the Global Times.

Diageo's localization strategy

Diageo, whose brands include Johnnie Walker whiskey, Guinness beer, Smirnoff vodka, Bailey's Irish Cream, Cuervo tequila and Captain Morgan rum, began to sell its brands in China in 1995, and moved forward in 2007 when it paid 517 million yuan ($75 million) to acquire a 43 percent stake in Quanxing, a baijiu maker. It later invested 140 million yuan ($21 million) to acquire an additional 6 percent stake in July 2008.

"This increase in our strategic shareholding underlines the strength of our partnership with Quanxing, our belief in the strong prospects for the Chinese white spirits category and our increasing commitment to Sichuan and to China as an excellent place to do business," Diageo Chief Executive Paul Walsh said in a July 2008 press release.

Quanxing is SCSF's biggest shareholder with a 39.63 percent stake, so these investments also increased Diageo's indirect interest in SCSF and meant that Diageo owned a 19.42 percent stake in the company.

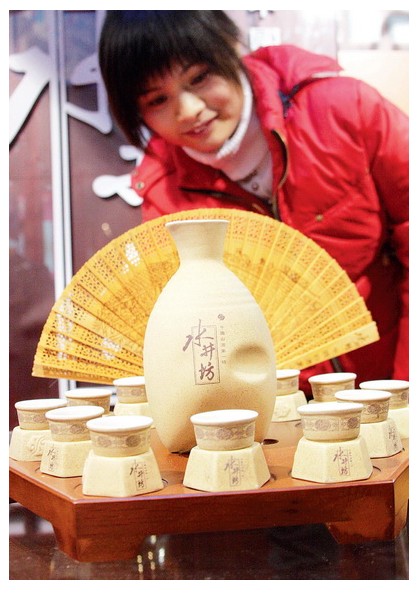

The 2007 deal included setting up a joint venture as a base for packaging Diageo's spirits products in China and developing sales to overseas Chinese of SCSF's Shui Jing Fang brand, a high-end baijiu that retails for 560 yuan ($82) a bottle.

Diageo signed an agreement with Sichuan Province to build a packaging center for its products in June 2008.

"We will continue to invest in the Chinese white spirits industry in Sichuan," Kenneth Macpherson, managing director of Diageo Greater China, said at the signing ceremony.

Diageo and SCSF also launched a new Chengdu-made premium vodka brand, Shanghai White in Hong Kong in June this year that combines the distilling process of both vodka and baijiu. Shanghai White is sold at a suggested retail price of HK$470 ($60).

However, SCSF hasn't performed as well as its rivals such as Kweichow Moutai and Wuliangye Yibin during the economic slowdown.

For the first half of this year, SCSF reported an income of 441 million yuan ($64 million), a 19.49 percent decrease year-on-year, and a net profit of 103 million yuan ($15 million), 22.83 percent down year-on-year. Its export income also decreased by 81.27 percent to 1.6 million yuan ($234,000), only accounting for 0.4 percent of the total income.

The company's premium baijiu sales decreased due to the global financial crisis, said SCSF in its interim report.

Stiff competition

Roughly five billion litres of spirits are consumed every year in China. The vast majority is baijiu, and the consumption of all foreign spirits is estimated at less than 1 percent of the total.

There are more than 18,000 baijiu producers in China, and their total sales income amounted to over 140 billion yuan ($20 billion) in 2008, a 30 percent increase year-on-year, according to China National Association for Liquor and Spirits Circulation.

Figures from Nielsen show in the first four months of this year, baijiusales increased by 15.8 percent from a year earlier in 18 domestic cities, while whisky sales remained the same and brandy sales decreased by 22.4 percent.

"Cultural differences and consumer habits are the main barriers for foreign spirits producers expanding their business in China," said SZIC's Chen.

Foreign spirits such as whiskey and brandy are mostly consumed by young people at pubs and clubs, while baijiu are widely consumed at restaurants and home, or sent as gifts, Yang Qingshan, secretary-general of the China Association of Branding Strategy (CABS), told the Global Times.

The high growth of China's baijiu market has consistently attracted overseas investors, and they focus on well-known domestic companies, said Zhao Jianhua, secretary-general of the White Spirits Branch of the China Alcoholic Drinks Industry Association.

"Foreign spirits magnates first share participation in domestic baijiu companies, then they have the intention to take a controlling stake," said Yang.

Large amounts of foreign capital have been injected into domestic baijiuproducers since 2005, when Thailand's TCC Group spent 55 million yuan ($8 million) buying out Yulinquan Brewery in Yunnan Province.

Following Diageo's step into China's baijiu market, France-based Moet Hennessy, the wines and spirits business of LVMH, spent 960 million yuan ($141 million) acquiring a 55 percent stake in Wen Jun Distillery from Jiannanchun Group, the third largest producer by revenue, in May 2007. They rebranded the Wen Jun brand as a high-end product selling at 598 yuan ($88).

Swedish Vin&Sprit, the Absolut vodka maker purchased by Pernod Ricard in March 2008, also formed a joint venture with Jiannanchun Group in May 2007 and owns a 51 percent stake. The company launched a premium baijiu brand Tian Cheng Xiang in March 2008.

However, these high-end spirits don't sell well, according to CABS's Yang. "Wen Jun and Tian Cheng Xiang haven't been easily accepted by Chinese consumers, who are used to drinking traditional brands and Shanghai White is only available in Hong Kong."

"Premium baijiu only accounted for less than 1 percent of the total baijiu market share, but their profit margin is as high as 50 percent," said Chen.

"Traditional baijiu still dominate the domestic spirits market, and foreign spirits producers should concentrate on their products' taste and promotion to expand their business,"he added.