Importing Wine in China: An Oligopoly ?

To have an overview of the wine market in China before starting reading this post, I urge you to read what I wrote about the wine business in China. It also can be interesting to read what Lucas wrote about the wine distribution in China

To start with this controversial article, let’s see what Wikipedia writes about oligopoly:

“An oligopoly is a market form in which a market or industry is dominated by a small number of sellers (oligopolists)”

There are a lot of different companies importing and distributing wine in China, no doubt of that. But we want to show that the market is controlled by a few companies. It is therefore really difficult for newcomers to compete.

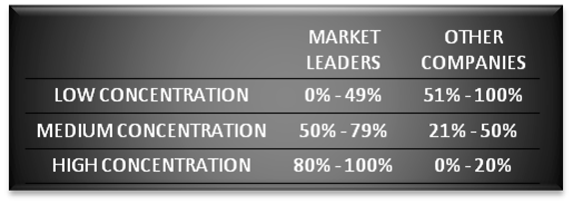

The concentration of an industry is measured by the Concentration Ratio. The Concentration Ratio is the percentage of market share held by the largest firms in an industry. One can use either the Four-Firm Concentration Ratio or the Eight-Firm Concentration ratio. So let’s take the 8 market leaders in the importing wine business in China: ASC, Summergate, French Wine Paradox, Torres, Mercuris, Aussino, DT Asia, Castel. (As these are private companies that do not disclose their income statement, it is actually difficult to range them and I might have forgotten some important ones in the study. My apologies)

Let s not be too specific and see this with a graph. As my grandfather said, a drawing is easier to understand than a long speech (and my grandfather was a wise man):

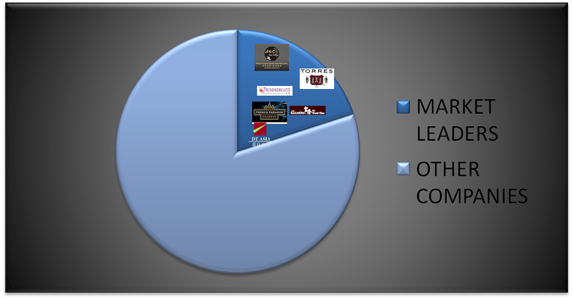

We consider a market is an oligopoly from a market share of 50% held by the market leaders. So the question, we have to ask ourselves is either the business of importing wine in China looks more like this:

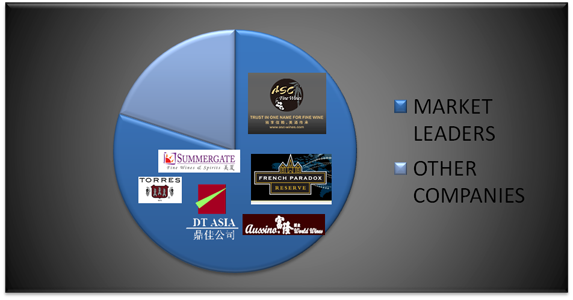

or more like this:

Today, we can easily say that more than 50% of the wine imported to China is imported by one of these 8 companies

What I want to show is that the concentration of the industry is doomed to grow even more and this for two main reasons:

As Yann Soenen of Mumm Perrier Jouet and PENG Jia of the world wine education in Shanghai said in recent interviews, brand is the key in China. The market will grow thanks to big brands nationally and internationaly recognized. Therefore, these are two strategies to develop your market share when you are importing wine in China. Either you build your own brand designed for the Chinese market (national recognition). It is the strategy chosen by 9519 wines with Camons and by FWP with French Paradox. or you import internationally recognized brands of wines. In both cases, early movers importers control the wine industry value chain. They have the possibility to develop their own brand because they control distribution channels. On the contrary, developing its own brand for a newcomer importer is difficult because it will be hard to find customers to promote an unknown brand even if it is designed specifically for the Chinese market.

The second strategy is to import internationally recognized brand. But big brands are already distributed all over China. For example M.Chapoutier by Torres, Jacob s creek by Pernod Ricard. Georges Duboeuf by FWP, Lafite, Yalumba and D aremberg by Summergate. Chateau Latour, E.Guigal, Louis Jadot and Gaja by ASC, Taylor’s and Champagne Nicolas Feuillate by Aussino, Delas, Domaines Schlumberger, Champagne Deutz and Gosset by DT Asia…

It leaves no place for newcomers. Especially because importers have signed exclusive distribution agreements with such big names.

For brands that would still be out of the Chinese market (and fewer and fewer brands are not already in China), they are more likely to choose a well known importer that can promote wine all over China than a newcomer. And this would therefore accentuate the concentration of the wine distribution in China

So the question is how to compete on such a concentrated market ? It will be the subject of a next post but we can already say that there are two main strategies: Develop a distribution network in a second tier city or specialized in the distribution of niche wines.

Drink well !