Barrel of oil or a bottle of wine?

By Charles Lewis Sizemore, CFA

According to new research released by the International Monetary Fund, there is little difference in the two, at least from an investment standpoint.

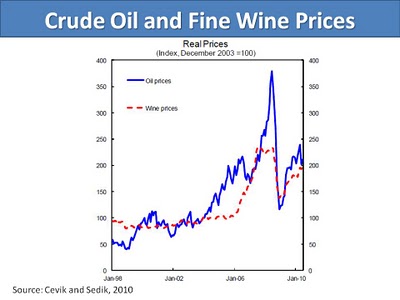

In their 2010 whitepaper, Serhan Cevik and Tahsin Saadi Sedik found that supply constraints have surprisingly little impact on the prices of commodities. The researchers found that macroeconomic factors are the main determinants of commodity prices, particularly growth in emerging markets. “Excess global liquidity” (i.e. quantitative easing) and the securitization of commodities into new ETF and mutual fund products for retail investors were also significant contributors. But global aggregate demand appears to be the main driver for commodity prices, even two as seemingly diverse as crude oil and fine wine.

Fine wine has become something of a fashionable asset class for many high-net-worth investors. With bonds yielding almost nothing and stocks coming off a losing decade, you certainly can't blame the rich for looking for returns elsewhere. But rather than incur the high transactions and storage costs that come with an investment in fine wine, wealthy investors could have had substantially the same performance from buying and rolling over a portfolio of far more mundane oil futures. From 1990 to 2010, the correlation between fine wine and crude oil returns was a staggering 90 percent! (See Chart)

The researchers conclude that “although fine wine can be considered as an investable asset, its behavior is not significantly different than other commodities and therefore may fail to enhance portfolio diversification.”

Our advice to investors would be to follow the lead of China's new rich. Wealthy Chinese celebrate their success by buying fine wine—and drinking it rather than locking it in a cellar (see For Opportunities in the Luxury Sector, Look East for the SIL's comments on China's love affair with wine.)

Cevik and Sedik's paper suggests that both crude oil and fine wine are, in effect, Emerging Market Lite investments. Most retail investors, however, would be better served leaving oil to the commodities traders and wine to the oenophiles.

Buying shares of underpriced, world-leading companies with significant exposure to the rising Emerging Market Consumer is a safer alternative that is likely to be more profitable over the long term.

One good alternative would be the Powershares International Dividend Achievers ETF (NYSE: PID). This Powershares ETF is a collection of some of the finest dividend-paying stocks outside of the United States, and many–such as Telefonica (NYSE: TEF), Diageo (NYSE: DEO) and Unilever (NYSE: UL)– have been highlighted by the Sizemore Investment Letter for their exposure to emerging markets. A second, more direct option would be the EG Shares Emerging Markets Consumer ETF (NYSE: ECON), which gives you direct exposure to the companies in the developing world selling to domestic consumers.

Drink your fine wine, and consider these two ETFs as long-term investments.