American domestic wine sales jump 8% in March

Numbers imply price increases; imports still discounting

Domestic wine dollars and volume growth were nearly equal, according to sales data from major food and drug stores.

San Rafael, Calif.—Domestic table wine sales dramatically increased their year-on-year rate of growth to nearly 8% in the four weeks ending March 20, after perking along at around 6% growth for many months. The Symphony IRI Group (SIRI) recorded $345 million in sales for this category at the major food and drug stores where it analyzes check stand scan data.March is typically one of the slow months of the year for off-premise wine sales, and indeed the March total in dollars was slightly smaller than February’s sum. Still, the noteworthy jump in the growth rate over 2010 must be heartening to wineries and retailers that have been wondering when the wine industry recovery would really take hold.

The percentage change in volume of wine sold vs. last March was only up 6% for domestic table wines, meaning that the nice spike in dollar sales did not come from discounted prices. It appeared that prices had firmed, and at least some had increased.

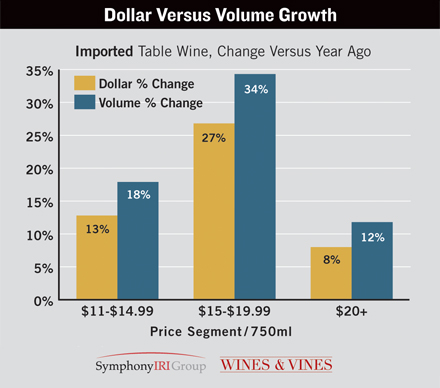

Imported wine sales in three premium price segments grew faster in volume than dollars during the first quarter, an indication of price discounting.

Some imports grew during the first quarter

First-quarter totals from SIRI showed that despite the overall uptick for domestic wines, imports in two of the highest price segments grew faster than domestics. Imports priced from $11 to $14.99 outpaced domestics 13% to 6% in dollar sales. Imports from $15 to $19.99 grew at a blistering pace of 27% vs. domestics at 8%.

Imports in these segments grew faster in volume than dollars, however, indicating the reverse of the domestic wine situation. “Imports are really deep discounting compared to the domestic wines,” observed Doug Goodwin, SIRI’s vice president of client insights for wine, beer and spirits. “We warned domestic producers to keep an eye on imports.”

The accompanying graphs compare domestic and import sales growth for the first three months of 2011 in SIRI’s three highest-price segments. It’s easy to see that domestic wine growth was nearly identical in dollars and in volume at these price-points. “Domestics are stabilized at their price levels,” Goodwin said.

The high-priced imports, by contrast, increased several percentage points in volume than they did in dollars. Bottle prices for imports dropped by 53 cents, 90 cents and 77 cents in these three segments.

What’s hot, what’s not

First-quarter totals by varietal showed that Pinot Noir and Pinot Grigio/Gris were the hottest of the big sellers between $11 and $14.99 in terms of dollar sales growth. Among $15 to $19.99 wines, red blends and Riesling led the major varietals. At the $20-plus level, Pinot Noir, Cabernet Sauvignon and Sauvignon Blanc grew the fastest of the large-volume varietals.

White Zinfandel stood out in the first quarter in the two next-to-the-top price tiers. Sales grew at 56% and 61% from a very small base. Few White Zinfandels have been priced at $11 or more in recent years, so this might be a trend to watch.

Oregon led the states in sales growth percentage during the first quarter, adding 19% more dollars than first quarter of 2010. California, with about 80 times the sales volume of Oregon, grew steadily at 6%, while Washington (the No. 2 state in wine production) managed 4% growth.

The hot list of import countries starts with Argentina. The South American country’s dollar sales at retail went up 34% in the first quarter on the strength of fast-selling Malbec. New Zealand was the second-fastest growing import, up 24% over first quarter of 2010. Italian wines improved their growth rate to 11%, while Australian wines—the biggest category of imports in SIRI’s data—dropped 10%.