Chinese liquor producer to exit from property development

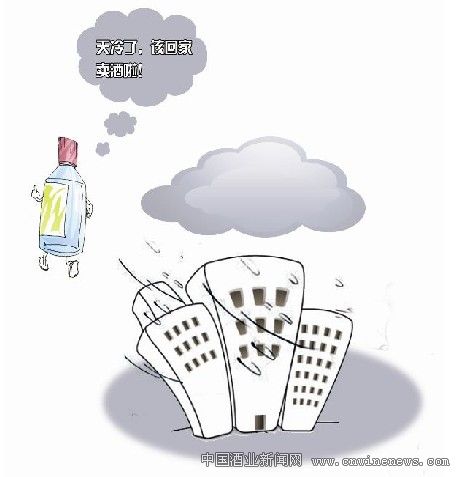

CHENGDU, Nov 25, 2011 (SinoCast Daily Business Beat via COMTEX) -- Sichuan Swellfun Co., Ltd., a premium Chinese liquor producer, expects to exit from a real estate project in Pi County so as to focus on the core liquor business.

The company's wholly owned subsidiary owns 535-mu lands in Pi County that are approved to be developed for commercial and residential use. These lands are worth CNY 530 million in cost of book value and have yet to be developed so far.

Orient Securities comments that Sichuan Swellfun needs to allocate current resources into the core liquor business amid the stiffer competition in the sector, so it has to spin off the real estate project.

On the other hand, the nation's macro control over real estate sector weakens the company's cost advantages in real estate development; related authorities' requirements on listed companies' refinancing hold back the refinancing of listed companies that have real estate projects.

In the first three quarters of 2011, Shanghai-listed Sichuan Swellfun got CNY 1.059 billion operating revenue, up 17.41% year on year. Operating profit increased by 44.69% year on year to CNY 291 million and net profit surged 82.03% year on year to CNY 213 million. Earnings per share were CNY 0.44.

Some other Chinese liquor producers exited from real estate sector earlier. Shenzhen-listed Jiugui Liquor Co., Ltd. announced this June that it sold all 20% stake in some real estate developer. Shanghai-listed Anhui Golden Seed Winery Co. last July transferred the real estate development business to the parent Anhui Golden Seed Group Co.

China's continuous macro control puts an end to the exorbitant profit of real estate development while the gross profit margin of liquor is rising rapidly following price rises in recent two years. Prices of some liquors have been raised by over 10% since the start of 2011. Many listed liquor producers in the 2011 first-half financial reports post up to 60%-80% gross profit margin in the liquor business, compared with the 20%-30% gross profit margin for residential properties and 50%-60% for business properties. Jiugui Liquor had a 72.59% gross profit margin and even 85.31% for top-end liquor in the first half. Renowned Chinese liquor producer Kweichow Moutai Co., Ltd. reaped CNY 6.569 billion net profit in the first three quarters, representing a year-on-year surge of 57.37%. Meanwhile, China Vanke Co., the country's largest real estate developer by market value, saw its net profit advance 9.53% year on year to CNY 3.584 billion.

Food and beverage Index has advanced 1.1% in the year to date, outperforming the Shanghai Composite Index by 15%. Especially, the sub-index for liquor gained 7.6% with 21.5% extra yield.