Diageo gains Chinese approval for its Shuijingfang tender

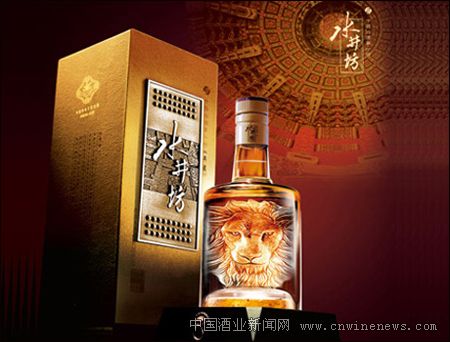

Diageo Plc (DGE), the world’s largest liquor company, said it gained regulatory approval to buy the outstanding shares in Sichuan Shuijingfang Co. Ltd. as part of its acquisition of one of China’s biggest white-spirits makers.

The China Securities Regulatory Commission cleared Diageo’s mandatory tender offer for 60.3 percent of Shanghai-listed Shuijingfang, the distiller said today in a statement. The offer was necessitated by Diageo taking majority control last year of a company that owns a 39.7 percent stake in Shuijingfang.

The maximum amount payable if the offer is accepted by all shareholders will be about 6.3 billion yuan ($996 million), which the London-based company said it will fund through “diversified financial resources.” The offer price is set at 21.45 yuan a share, the minimum allowed by Chinese takeover regulations, Diageo said. That’s 17 percent lower than yesterday’s share price on the Shanghai stock exchange.

Diageo increased its stake in Sichuan Chengdu Quanxing Group Co. to about 53 percent in June last year as it seeks to expand its presence in China and distribute and manufacture a traditional Chinese liquor known as baijiu.

The distiller, which competes with international companies including Pernod Ricard SA (RI) in China, is seeking to expand into the country’s local spirits category as booming economic growth increases alcohol consumption. Imported spirits, including Diageo’s Smirnoff vodka and Johnnie Walker Scotch whisky, represent 2 percent of China’s spirits market volume.

Diageo is chasing a greater percentage of sales from emerging markets compared with the U.S. and Europe, where government budget cuts and high unemployment are restraining sales growth. So-called organic sales rose 18 percent in the first half in Greater China, it said, compared with a 5 percent increase in North America and unchanged sales in Europe.

Diageo is working with Citic Securities Co., UBS AG and HSBC Holdings Plc on the tender offer.