Economic boom in China sends booze market skyrocketing(2)

Sector challenges

Health and safety concerns

Given the country's preference for high-strength baijiu, health and safety issues associated with alcohol are a concern. In the last 10 years, China's alcohol consumption patterns have changed dramatically, from strong demand for the highly potent baijiu to the increased popularity of low- or no-alcohol beer. According to MDA data, between 2000 and 2009, the per capita consumption of low- or no-alcohol beer increased by 11 percent a year, compared to an annual increase of 7 percent for alcoholic beverages overall.

The PRC government only recently enacted a minimum drinking age and laws that prohibit the consumption of alcohol among children. In 2006, the government introduced a law that bans the sale of alcoholic beverages to consumers below the age of 18. In addition, the government in August 2009 increased the base tax and consumption tax rates on high-strength alcohol, including baijiu. Increased taxes on spirits and other high-strength alcohol, coupled with media and industry promotions for healthier drinking habits, have affected consumer choices, and more consumers are choosing lower-strength alcohol.

New alcoholic beverage launches reflect this trend toward healthier alternatives, as wines made up more than half of new products launched in China's alcoholic beverage sector in 2009 and nearly 40 percent of such new product launches in 2010.

Competition

China's alcoholic beverage market is dominated by major companies such as SABMiller plc, Tsingtao Brewery Co., Ltd., Anheuser-Busch InBev SA/NV, Molson Coors Brewing Co., and Beijing Yanjing Beer Group Corp. According to MDA data, these top five companies together controlled 57 percent of market volume in 2009.

Interestingly, the top five players in China's alcoholic beverage sector are also the top five players in the beer, cider, and FABs category, suggesting that this category drives the overall alcoholic beverages sector. The top five wine companies in China are domestic firms: Yantai Changyu Group Co., Ltd.; China Great Wall Wine Co., Ltd.; Tonghua Grape Wine Co., Ltd.; Dynasty Fine Wines Group Ltd.; and Yantai Weilong Grape Wine Co. Ltd.

Though the beer and wine markets are highly concentrated—with the top five players commanding market shares of 81 percent and 62 percent, respectively—the spirits market in China is more fragmented. In 2009, the top five players contributed a meager 2 percent of total spirits sales. This is because the spirits market reflects the local market for baijiu, which is primarily produced by smaller local companies, rather than by large international companies.

The top players in China's alcoholic beverage sector are consolidating by acquiring smaller firms to gain market share and access to lower-tier cities in China. A few merger and acquisition deals have occurred among alcoholic beverage companies in recent years. In the first half of 2009, four out of five deals involved large market players such as Anheuser-Busch InBev, Carlsberg Breweries A/S, and Tsingtao Brewery. That year, Denmark-based brewer Carlsberg increased its stake in Xinjiang Lanjian Jianiang Investment Co., Ltd., the company that owns the Xinjiang market leader Xinjiang Wusu Brewery Co., Ltd. Following the deal, Carlsberg held a 63.4 percent stake in the brewery.

Companies will also face competition from counterfeit brands, which generally target lower-income consumer groups. Counterfeit alcohol brands are so prevalent in the country that some alcoholic beverage manufacturers have been forced to take special measures to preserve their brand images and market shares. For example Diageo, the parent company of the premium whisky brand Johnnie Walker, has located special teams at bars and pubs to spot-check bottles to ensure their authenticity. The Australian wine industry, which is a large exporter of wines to China, and Canadian ice wines, which are one of the most coveted wines in Asia, are being counterfeited and sold at lower price points.

Local tastes

Akin to most other food and beverage sectors, China's alcoholic beverages sector attracts many popular international brands. To reach target consumers, many foreign players attempt to localize their products to suit Chinese preferences. For example, the French alcoholic beverage company Pernod Ricard SA has not only localized its staff and operations through a vineyard in China, but it has also customized the way that its Chivas Regal Scotch whiskey is consumed. Observing that Chinese like green tea as a mixer in their spirits, the company began promoting canned green tea as a mixer with its whiskey products instead of encouraging Chinese consumers to drink Scotch neat, straight up, or on the rocks.

Wine Is Booming Ahead

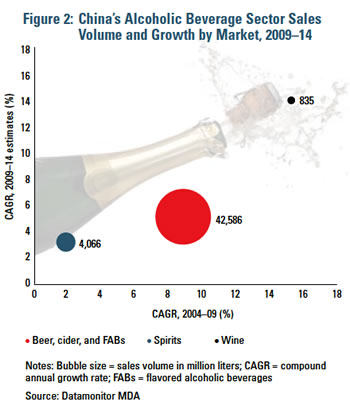

Because of its large customer base, China's beer, cider, and FABs market will likely experience moderate growth over the next five years (see Figure 2). In contrast, the wine market, with its smaller base, is expected to rise at a much faster rate. The spirits market may suffer from various government measures to reduce the consumption of high-strength alcohol, especially baijiu. The brandy and rum markets may rise twice as fast as the overall alcohol sector until 2015, however, and gin and tequila may experience a rise in demand.

Chinese consumers are changing their drinking preferences. The country's alcoholic beverage sector is benefitting from consumers that are increasingly eager to experiment with Western brands and lower-strength products. And women are an expanding consumer group that is boosting wine sales.

Amidst various challenges in the country's alcoholic beverage sector, companies should focus on consumer education. As nascent markets for most foreign brands, China's spirits and wine markets abound with counterfeits and fake brands. Massive marketing campaigns along with consumer education on the product's quality credentials may help companies tap their target consumers and combat competition from counterfeit brands. Furthermore, considering Chinese consumers' rising incomes and aspirations, companies may choose to brand their products as "premium" or "upscale," a claim that is expected to attract many wealthy consumers in China.