Weak dollar makes equipment expensive, but promotes exports

The strength of the Euro keeps equipment prices high.

Pasco, Wash.—Greater consumer confidence may be strengthening wine sales, but many wineries continue to suffer effects of the great recession of in the form of a weakened U.S. dollar.

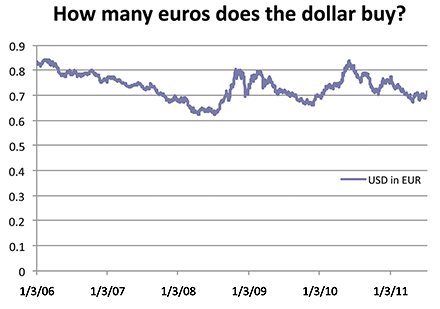

A decade ago, the greenback bought 1.17 euros; even five years ago it was worth 0.78 euros. This week, a dollar buys a mere 0.71 euros. This contributes to higher costs for barrels, equipment and other items sold in euros.

“A falling dollar makes the (European) barrels, which are all priced in euros, considerably more expensive,” said Ed Casey, a senior director, business development with Western Union Business Solutions.

The situation is keeping wineries watching markets or contracting foreign exchange managers such as Western Union to monitor markets on their behalf. “We’re seeing an increase in market intelligence and market savvy by some of the smaller wineries wanting to protect their profit margins,” Casey said.

He doesn’t foresee a recovery in the short-term either, unless the financial woes of European nations such as Portugal, Italy and Greece hammer the euro harder than the showdown over U.S. debt ceiling hits the greenback.

“This payment season … is going to be a tough one in terms of the cost of euros, and next year I don’t expect to be too much better than this,” Casey told Wines & Vines. “There’s just so much uncertainty that it’s hard to project long-term, other than to say it’s going to be status quo until there are some real positive developments going on out there.”

With unemployment running at 9.2% nationally and lackluster growth prospects dampening demand for money, there will be little incentive to raise interest rates. This, in turn, will keep demand for U.S. dollars on international markets in check, and the dollar’s value depressed.

Speaking from his office in Pasco, Wash., Northwest Farm Credit regional vice-president Bill Shibley said these factors support his own expectation the dollar won’t strengthen any time soon. “I’m clearly not a bond trader on Wall Street, and I don’t like to predict interest rates. At the same time, I think there’s at least equal opposing pressure on keeping rates down as any upward pressure,” he said. “We’re in for a slow—brutally slow—recovery.”

Shibley has been lending to the wine industry for more than 15 years, and oversees Northwest Farm Credit’s lending in the Columbia Basin territory that stretches from Walla Walla, Wash. to The Dalles, Ore. He said the wineries he works with appear to be handling the new environment well, however.

“They’re more prepared for the—what’s the cliché?—new normal,” he said. “2008 was such a strong wake-up call that they’ve trimmed inventories, tightened things up and are less growth-oriented.”

Bright market for exports

This has prompted many to look to markets overseas. Domestic wine sales may be improving, and current exchange rates make imports more expensive relative to U.S. wines, but vintners aren’t taking the gains for granted.

A weak dollar also makes U.S. wines more attractive to countries with strong economies and greater purchasing power. Northwest Farm Credit’s latest wine industry snapshot identifies Canada, China, Denmark, Germany, Japan and India among areas where wineries are appreciating export potential.

Dane Narbaitz, president of 14,000-case Long Shadows Vintners LLC in Walla Walla, told Wines & Vines that Denmark, Germany and Switzerland have emerged as good markets for the company. Smart pricing and favorable exchange rates have also given Long Shadows’ brands a competitive edge in Canada. Its latest releases in neighboring British Columbia are tagged from $4.50 (Canadian) to CAD$14.50 below last year’s offerings.

Western Union, for its part, is helping an increasing number of small to mid-sized wineries not only to hedge on foreign purchases but also to collect on foreign sales. China and the United Arab Emirates are just two markets where wineries use the service to handle foreign payments.

Exports of U.S. wines haven’t been uniformly welcomed. A report last week by BMO Capital Markets regarding Canada’s wine industry noted that a strong currency is putting a damper on domestic vintners’ ambitions. “Producers have been ceding ground as import competition has intensified,” the report said, pointing to a strong Canadian dollar that makes U.S. wines more affordable to Canadians.

This hasn’t been helped by consumers who are as anxious about economic conditions as their neighbors to the south; Canadians, too, have been keeping close tabs on spending. “Spending restraint will limit the size of the market, while currency appreciation will hurt the industry’s competitiveness and ability to gain or hold onto market share,” the bank said.

Perhaps the one bright spot across North America is the growth in wine sales to Millennials, a generation now approaching its 30s. “U.S. demographics are in our favor,” Shibley said. “The Millennials are drinking more wine, and that’s a wonderful thing.”

- “中国梦·世界情”中国品牌全球行北京首发盛大启航

- 5-29

- 雷雁

- 毛铺苦荞酒获“白酒国家评委感官质量奖”

- 8-18

- 童国强

- 这些地方招人,博大酒水人才网带你去看看!

- 5-29

- 第93届全国糖酒会为何选择南京——专访全国糖酒会办公室主任古平

- 5-29

- 孙文东

根据《中华人民共和国著作权法》及《最高人民法院关于审理涉及计算机网络著作权纠纷案件适用法律若干问题的解释》的规定,本网站声明:

凡本网注明“来源:《华夏酒报》”或“来源:中国酒业新闻网”的所有作品,版权均属于华夏酒报社和中国酒业新闻网,未经本网授权不得转载、摘编或利用其它方式使用上述作品。已经本网授权使用作品的,应在授权范围内使用,并注明来源:《华夏酒报》或中国酒业新闻网。违反上述声明者,本网将追究其相关法律责任。

凡本网注明来源:XXX(非中国酒业新闻网)的作品,均转载自其它媒体,转载目的在于传递更多信息,并不代表本网赞同其观点和对其真实性负责。我们力所能及地注明初始来源和原创作者,如果您觉得侵犯了您的权益,请通知我们,我们会立即改正。

如因作品内容、版权和其它问题需要同本网联系的,请在30日内进行。 如果您有任何疑问,请联系我们:wlb@hxjb.cn

互联时代,酒类电商的明日走势

互联时代,酒类电商的明日走势 一购三赢?详解青青稞酒并购“中酒网”

一购三赢?详解青青稞酒并购“中酒网” 华夏酒报荣获中国商业文化建设传播奖

华夏酒报荣获中国商业文化建设传播奖 三条酒类广告禁令考量社会责任

三条酒类广告禁令考量社会责任